Striking Similarity between Guyana, Israel’s Leviathan basin is what attracted us–Ratio Geologist, Co-Founder

By Kiana Wilburg

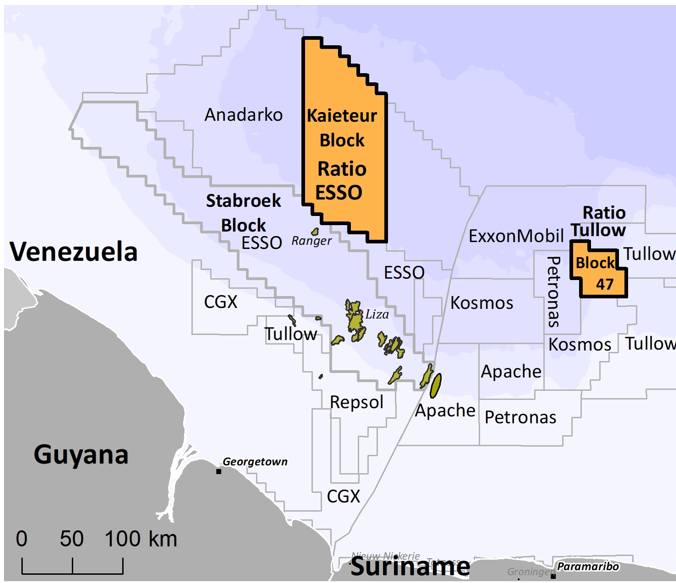

Before American oil giant, ExxonMobil, made 13 successful discoveries in the oil-rich Stabroek Block, the multinational was hard-pressed to persuade other oil majors to join its exploration campaign after Royal Dutch Shell threw in the towel in 2014.

In fact, Exxon went knocking on the doors of 22 other firms, with only two answering the call to invest in a basin that was essentially deemed by most to be “too risky.”

But even before ExxonMobil and its two new partners, Hess Corporation and China’s state-owned CNOOC//NEXEN, had a Liza-type taste of what the Stabroek Block would produce, one Israeli company affirms that it knew since early 2012, that the Guyana basin was flooded with potential.

During an exclusive interview with Kaieteur News, one of Ratio Petroleum’s co-founders and Senior Vice President (SVP) of Exploration and Production, Eitan Aizenberg, said he knew three years before Exxon struck black gold that the Guyana basin was unquestionably, well endowed.

Aizenberg asserted that he was able to make this observation given his years of experience in operating in the Israeli basin and other parts of the world.

But in order to understand his subsequent entrance into the Guyana basin via the acquisition of the Kaieteur Block, of which Exxon is now the Operator, the geologist intimated that one has to understand a little of the firm’s background.

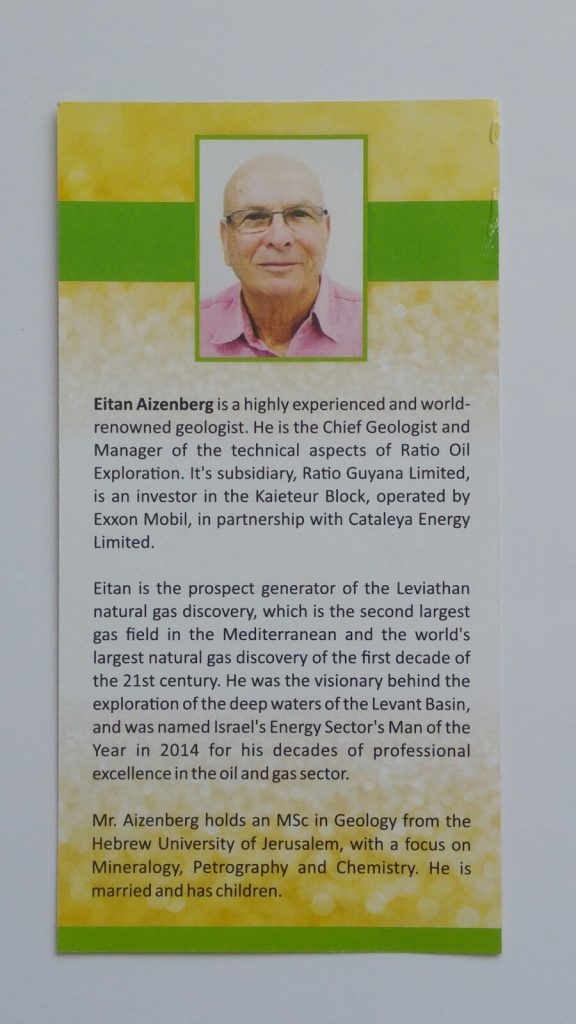

The entrepreneur said that Ratio started its activities in the early 1990s as a partnership between two pioneering Israeli business families – the Landau and Rotlevy. Aizenberg noted that both families are well known in Israel and are highly appreciated for their contribution to the growth and development of the Israeli economy.

The geologist said, “Ratio’s exploration and production activity started as a joint venture of the Landau and Rotlevy families together with me in 1992, to explore for hydrocarbons in Israel.

In those days, Israel had no significant discoveries and hundreds of dry wells were drilled. Ratio started with drilling wells onshore Israel which didn’t result in significant achievements – the wells turned out to be dry or not commercial.”

In 1999, the geologist said that Ratio shifted its efforts to the offshore. It was Aizenberg who led this decision as he believed that a great potential for hydrocarbons lay offshore, especially in deep water.

In fact, it was based on his long study of the Levant Basin (the basin offshore Israel) and decades of experience in Israel, Egypt, and the U.S, that informed this decision too.

Aizenberg shared, however, that the pursuit of the deepwater of the Levant Basin was not simple as those areas were already held by British Gas. This newspaper understands that British Gas had identified two promising prospects, Dalit and Tamar.

But it failed to find international partners to join them in drilling.

While looking for more partners, British Gas decided to relinquish some of the other areas it believed were not promising enough. One of these areas was where the Leviathan field would be discovered by Aizenberg in the future. But the geologist had already identified the potential of that relinquished area long before British Gas gave it up.

Ratio then applied for the area and it was granted along with the Ratio Yam permit from the State of Israel. Based on Aizenberg’s work in building the Leviathan prospect, Noble Energy and Delek joined Ratio to drill the Leviathan prospect. This resulted in the discovery of the giant Leviathan field which is equivalent to more than 3.6 billion barrels of oil, basically, three times the size of the Liza field.

LOOKING FURTHER AFIELD

Following the discovery of Leviathan, Aizenberg said he started looking further afield for promising opportunities where a similar success story could be recreated. Based on his extensive work, Aizenberg said he identified two potential basins that met the said criteria – the Guyana-Suriname Basin and Mozambique. The geologist shared that the decision within Ratio was to put the focus on Guyana.

Aizenberg further stated that his early investigations of the Guyana-Suriname Basin showed that exploration efforts had only produced numerous dry wells with zero discoveries. Despite this high risk, Aizenberg said he felt that Guyana’s offshore geology in the deepwater held many similarities to that of offshore Israel deep water.

Using the lessons that led to the discovery of Leviathan, Aizenberg said he was determined to enter the Guyana-Suriname Basin to acquire exploration rights.

He noted that an application for the Kaieteur Block in 2012 was then submitted to the Guyana Geology and Mines Commission (GGMC). It was subsequently approved.

SIMILARITIES

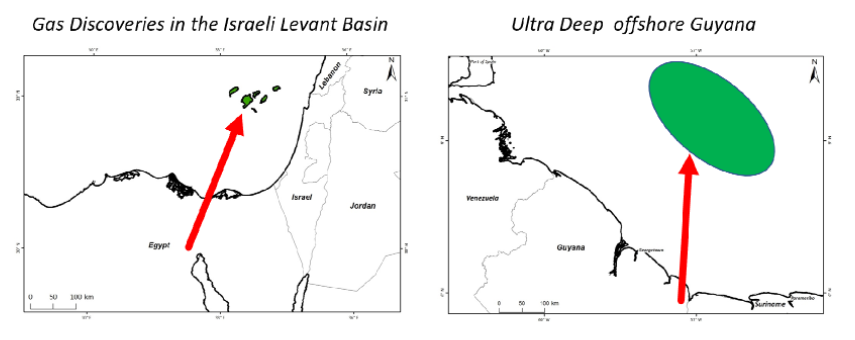

From an initial look, the Guyana-Suriname and Leviathan Basins have systems that look different.

But this is not the case for Aizenberg who has spent significant time studying the supply of sands to the deep waters of the Eastern Mediterranean (Levant Basin), which shares some significant similarities with the geology of the deep waters of the Guyana-Suriname Basin.

The geologist said, “Following our discovery of the giant Leviathan gas field in 2010 which proved my long-time insights were right, I started looking for underexplored basins around the world where these insights could be implemented again. In 2011, I spotted the Guyana-Suriname Basin and its similarities to the Levant Basin. One of the key elements in the quest for oil is finding a good reservoir, which in our case, is usually a sandy layer in the sub-surface which can carry and accumulate the oil reserves.”

He added, “As a first stage in my study, I looked for the source of these sands. In the East Mediterranean, we have the Crystalline rocks of the Arabian-Nubian Shield, and in Guyana we have the Guiana Shield: both excellent sources for sands then comes the mechanism of transporting these sands from their source to the sink (deep offshore).”

Aizenberg said that the equivalent of the ancient Nile River is the Old Berbice River which both carried the sands for a long journey of several hundred kilometers. He said that the critical time of the old Nile happened about 6-25 million years ago, while for offshore Guyana, the old Berbice river was active about 65-100 million years ago; which simply indicates, different times but the same mechanism.

Considering the aforementioned, Aizenberg said that Guyana was without a doubt, a sure investment destination. The geology spoke for itself, Aizenberg stated confidently.

(The Kaieteur Block is operated by Esso Exploration and Production Guyana Limited (35%) with partners Ratio Guyana Limited (25%), Cataleya Energy Limited (25%) and Hess Guyana Exploration Ltd. (15%).)

Source: